What caused the financial crisis that began in 2007, that time of cutbacks, job losses and housing foreclosures? And how can another crisis be prevented?

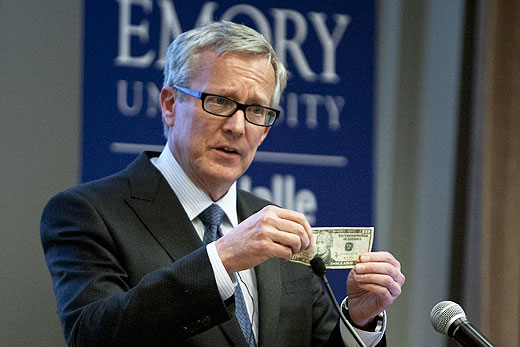

Yale professor Gary Gorton discussed causes and effects of the Great Recession in a workshop on financial and monetary history held May 21 at Goizueta Business School.

Gorton came to national attention in September 2010 when then-U.S. Federal Reserve Chairman Ben Bernanke, testifying before a national commission on the fiscal crisis, referenced Gorton's work as recommended reading for understanding the crisis.

"A financial crisis," Gorton told the Emory audience, "is a situation where households and companies don't believe that short-term bank debt is really backed with enough stuff and they want all their money back. So everyone goes to the bank at the same time and the banks don't have the money.

This same scenario happened in the 1930s, causing the Great Depression.

"Franklin Roosevelt explained this very, very clearly in his first radio address in March 1933. You can hear it on the Internet; it's fantastic,” Gorton recalled. “He said, 'Look, when you put your money in a bank, they don't just put it in a vault. They lend it out. So if everybody goes to the bank and asks for their money at the same time, the banks are not going to have it.' That's exactly what happened in 2007-2008.”

What caused the crisis this time around?

It wasn't "immoral, greedy bankers who created toxic assets for which they got inflated ratings and sold to stupid investors," Gorton said. "If banker greed causes crises, we'd have one every week."

One often-cited cause for the panic that began in 2007 is widespread default on subprime loans, money lent by banks to those who do not qualify for top-quality loans. While subprime loans started deteriorating in 2007, Gorton said the data compiled after the crisis shows that the problems related to these loans ultimately turned out to be miniscule; very little money was lost.

But to trigger a crisis, "you don't need a lot of problems” in the banking system — “you need some problems," Gorton said. When people or institutions lose confidence and want their money back, the banks have to come up with that money. So they sell what Gorton calls their “best stuff” and do it all at the same time so it isn't a domino effect.

Their best stuff is safe debt: U.S. Treasury bonds and bills and high-quality mortgages and other loans, he said. In other words, it’s debt backed by the U.S. government

Yet there is not enough safe debt to meet demand because the majority of the United States' high quality debt is held by other countries. "China buys and holds trillions of dollars of U.S. government debt because [that debt] holds its value," Gorton said.

"We owe a lot of money to China and the oil-producing countries because they buy debt, not goods. But we make more money selling them our debt instead of teddy bears or other products. The product we're selling is safe debt," he explained.

Private entities can’t create safe debt, even when they try, Gorton argued, and prior to the crisis, banks created risky debt to satisfy the demand for loans from businesses and would-be homeowners.

Some of that risky debt became bad debt. The problem in the recent financial crisis, he said, is that no one knew exactly where in the system the bad loans were.

"No one among the people explaining the financial crisis, be they academics or regulators or the press, knew where the problem was because we had no data telling us," he said.

Widespread loss of confidence

Being in the dark without data caused a widespread loss of confidence by enough depositors who wanted their money back that it led to the almost-collapse of the banking system and thus the recession.

A small thing set off this panic, Gorton said, and the small thing that happened was the news.

"The press didn't really do a very good job of explaining what was happening. But it's hard to blame them. They called economists and economists had no idea. If you call the experts and the experts don't know, how are you supposed to know? And the press — they're never going to get it right because the people who know aren't going to talk and the people who talk don't know," he explained.

"And in Congress, these people have nine million things they have to be experts on; they can't be experts on everything. In a lot of ways, it was a failure of the economics profession to explain things apparently in a way that the public could understand and that will lead to good policy."

So what can be done?

"You need a measurement system that can measure risk. I have a proposal about measuring," he said, declining to elaborate on his proposal. "But the momentum of this [Gorton's idea] has been lost already. We need about six more crises."

Gorton also advocates for government oversight. "Would you rather have the risk in an institution you oversee? Or push it somewhere where you don't even know where it is?"

The bottom line is “we should not have a crisis," Gorton said. "Canada doesn't have crises. So why can't we have a policy where you don't have crises?"